20+ Mortgage eligibility

The gov means its official. Federal government websites often end in gov or mil.

2

3056f eg Green Thumb Senior Aides Older American Community Service Employment Program.

. The Best 20-Year Mortgage Rates for 2022. 30 monthly mortgage servicing ratio. Zero low or manageable monthly debt obligations.

FHA expands mortgage eligibility for borrowers affected by COVID-19. Of the high-value funds one can avail of but also because of the option of flexible repayment tenors ranging up to 20 years. Assistance programs 20 USC.

Use Our Mortgage Qualification Calculator. Mortgage Affordability Calculator FOOTNOTES. You can and should calculate your mortgage payment for.

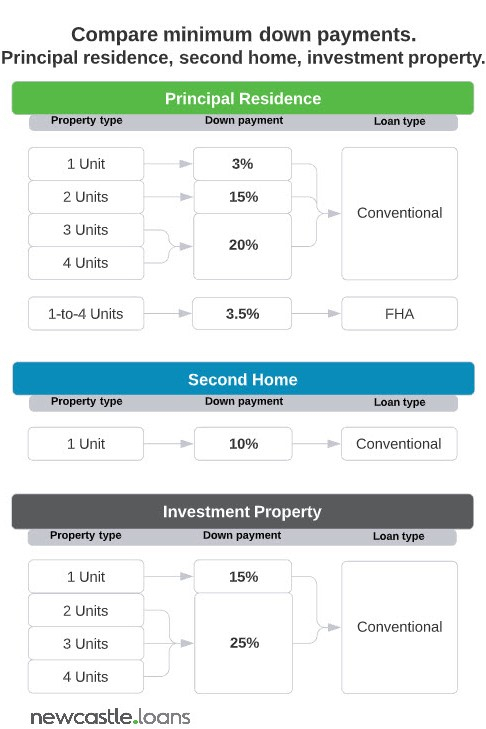

Down payments of less than 3 apply ONLY to the Habitat for Humanity program. Forbearance of residential mortgage loan payments for multifamily properties with federally backed loans. Typically about 10 to 20 of the propertys value.

Talk to your lender if you have one in mind about any additional details and requirements for what they can offer you. As Government Relief Programs change and some Financial Relief Plans offered by RBC come to an end rest assured that we will continue to work closely with you to provide the advice you need on an individualized basis. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

The Eligibility Matrix provides the comprehensive LTV CLTV and HCLTV ratio requirements for conventional first mortgage loans eligible for delivery to Fannie Mae. Mortgage insurance pays your lender if you default on your loan. Current minimum mortgage requirements for HomeReady and Home Possible Loans.

Even if you put 20 down youll be required to pay private mortgage insurance PMI. Gifts in the form of cash or equity are generally considered liquid assets. Apply online and youll get our best deals for you usually within 5 hours.

If you cant afford a 20 down payment on your home and apply for a conventional loan youll have to have private mortgage insurance PMI to cover the costs or just plain mortgage insurance for a government loan FHA loans or VA loans for example. 2022 USDA mortgage May 17 2022 Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

The Eligibility Matrix also includes credit score minimum reserve requirements in months and maximum debt-to-income ratio requirements for manually underwritten loans. Effectively your home loan eligibility is determined by the lender based on. Applicants must contribute 1 of their own funds into the transaction.

Home loan eligibility in India and across the globe is judged on your perceived ability to pay back. 2022 USDA mortgage May 17 2022 Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019. Refinancing into a conventional loan lets homeowners stop paying mortgage insurance premiums if they own at least 20 of the homes value as equity.

You can also check the mortgage loan interest rate before proceeding to the application process. FHA loans require you to pay a mortgage insurance premium MIP during the entire term of your mortgage unless you make a down payment of 10 or more. Try our Mobile Apps Android iOS.

Second mortgages come in two main forms home equity loans and home equity lines of credit. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. K Payments received on or after January 1 1989 from the Agent Orange Settlement Fund or any.

Second mortgage types Lump sum. Getting a mortgage can involve a lot of steps and you wouldnt want to get too far into the process before realizing you wont qualify after all. Before sharing sensitive information make sure youre on a federal government site.

Many clients are still facing financial challenges due to the economic impacts of COVID-19. 25- 70 years. Only include these costs if you have 10 or more payments remaining.

We have a 5-star Trustpilot score from thousands of reviews. Department of Agriculture backs USDA loans in the same way the Department of Veterans Affairs backs VA loans for eligible individuals such as veterans and their families. Malaysia home loan eligibility calculator to calculate your maximum housing loan amount in 2021 based on your annual income and ability to service the loan.

Get expert mortgage advice and brokering from the UKs best mortgage broker as voted for by the public. Homebuyers who have liquid assets of at least 20 of the purchase price of the property MAY not be eligible to use the Maryland Mortgage Program. Loans with less than 20 down will require Private Mortgage Insurance PMI.

Private mortgage insurance. A liquid asset is cash on hand or an asset that can be readily converted to cash. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. These loans require no money down for qualified borrowersas long as properties meet the USDAs eligibility rules. While the Government of Canada continues to offer.

VA-guaranteed loans are available for homes for your occupancy or a spouse andor dependent for active duty service members. The loan is secured on the borrowers property through a process. Eligibility now includes National Guard members with at least 90 days of active service including at least 30 consecutive days under Title 32 Sections 316 502 503 504 or 505.

A USDA home loan is a competitively priced mortgage option that helps to make purchasing a home more affordable for low-income individuals living in designated rural areas. However some borrowers making a 20 down payment or more on a one-unit home may be eligible for a property inspection waiver PIW and can skip a home appraisal. Expert mortgage advice by email and phone.

USDA eligibility and income limits. In that case MIP comes off after 11 years. 28 to 58 years.

Indian Maximum age considered at the time of loan maturity. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. PMI will typically cost between 05 and 25 of your loan.

USDA eligibility and income limits. Purchase Loans and Cash-Out Refinance. The mortgage loan requirements for these conventional low-down-payment programs include.

J Payments received from programs funded under Title V of the Older Americans Act of 1985 42 USC. Prior to ConsumerAffairs he was a programming consultant for radio and TV stations in some 20 markets around the US as. The Best 15-Year.

Use of telehealth to conduct face-to-face encounter prior to recertification of eligibility for hospice care during emergency period.

20 Easy Jobs That Pay Well With Examples Zippia

25 Upselling And Cross Selling Examples To Inspire Your Strategy Cross Selling Gift Registry Cards Gift Card Balance

2

How To Make A Flowchart In Word 20 Flowchart Templates

Jumbo Loan Without A 20 Down Payment Jumbo Source

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

A New Way To Achieve Homeownership

Principal Residence Second Home Or Investment Property How Occupancy Affects Your Mortgage

New Home Checklist Printable New Home Checklist Buying Your First Home Buying First Home

20 Home Buyer Seller Tip Instagram Story Canva Templates Etsy

Which Type Of Mortgage Loan Is Right For You Ally

20 Home Buyer Seller Tip Instagram Story Canva Templates Etsy

Jobless Americans Face Unemployment Benefit Cuts In More Than 20 States Forbes Advisor

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

What Is An Fha Appraisal Helpful Checklist Home Appraisal Fha Inspection Fha

New Home Checklist Printable New Home Checklist Buying Your First Home Buying First Home

Types Of Home Loans Amerhome Mortgage